Japan Dominates Outbound M&A Activity From Asia-Pacific in Q1 2017

Tokyo, Japan, 27 April 2017 – Japan dominates outbound M&A activity from Asia-Pacific in Q1 2017, according to the Cross-Border M&A Index published by Baker McKenzie and Mergermarket.

Japan took center stage

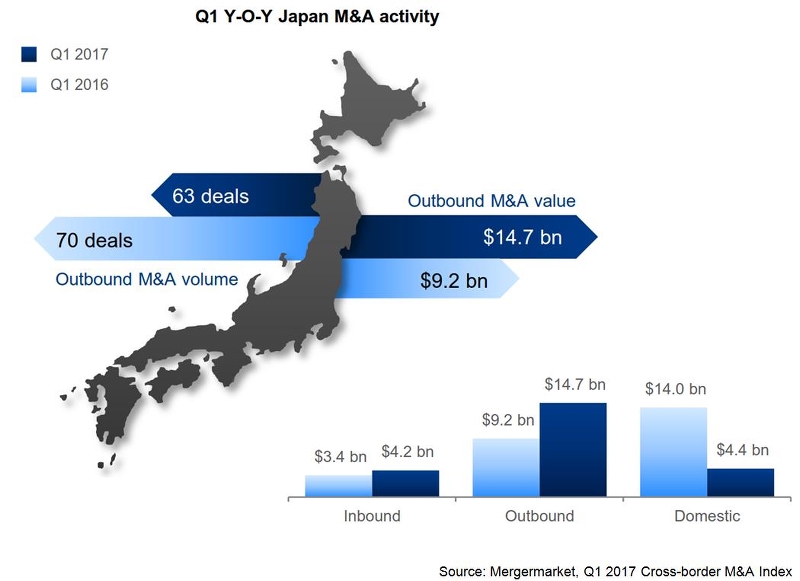

After a strong 2016, Japan has continued its cross-border M&A adventure in the first quarter of 2017. Japan took the lead on outbound M&A deal value from the Asia Pacific region, with 63 deals worth US$14.7 billion.

Japan outbound deals were spread across a number of sectors including financial services, telecommunications and industrials, however, the largest deal came from the pharmaceutical sector, Takeda Pharmaceutical’s US$4.9 billion acquisition of US biotech company Ariad. The three key regions of focus by Japanese dealmakers in the quarter were North America, Asia Pacific and EU.

Source: Mergermarket, Q1 2017 Cross-border M&A Index

A Focus on Industrials

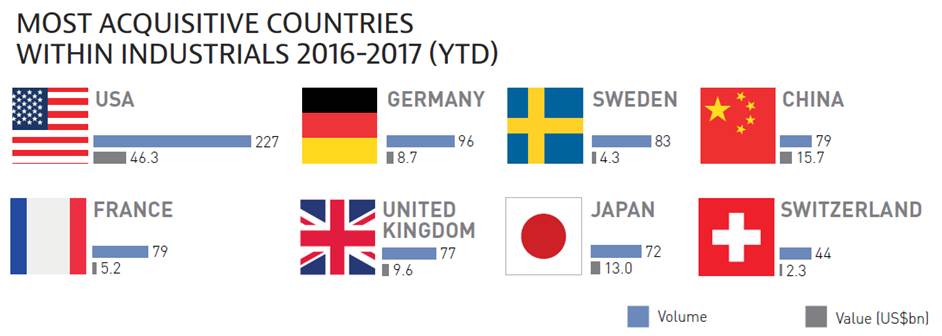

In 2016, there were 942 cross-border deals in the industrials sector, an increase of 23 on 2015 and a post-crisis record. Value also hit a post-crisis high of US$116.8 billion in 2016, a 48% increase over 2015. Japan was one of the most acquisitive countries in the industrials sector in 2016-2017 (YTD).

“The Japanese corporates are subject to a growing pressure from the market to restructure their businesses and to realize further growth. Opportunities in Japan are limited, and since last year we are seeing an increasing number of Japanese companies list overseas acquisitions as one of their key strategies in their midterm plans. The Japanese corporates’ appetite for outbound deals is not new for this quarter in this sense. However it is a fact that they are regaining confidence in their global expansion strategy, following certain geopolitical concerns and other uncertainties that made them more cautious last year. We believe that this trend should continue under the Japanese corporates’ mid-term strategies, but they will remain sensitive to any development of geopolitical concerns and other rapid changes in the investment climate,” said Akifusa Takada, co-head of Corporate/M&A Practice Group at Baker McKenzie’s Tokyo office.

Looking globally, the triggering of Article 50, uncertainty around the Trump administration and bruising electoral campaigns in the EU have coalesced to exert downward pressure on the M&A market in Q1 2017. There were 1,238 cross-border deals worth US$331.2 billion – a fall of 18% in volume but only 3% down in value compared with Q1 2016.

While China’s retreat from the deal table and the French election make the outlook for Q2 unpredictable, corporate confidence and a rising deal value average – US$537 billion, up 15% on Q4 2016 – mean that M&A value should continue to be strong, even if volume remains low.

For the entire Baker McKenzie’s Cross-Border M&A Index report (PDF), please click here.